Any plans to use local government pension funds to pay for housing projects would be open to a legal challenge, UNISON warned today.

As a report from The Future Homes Commission suggested today that pension funds could be used to pay for massive private housing projects, the union reminded the government that funds must be invested in the best interests of scheme members.

The union warned the government to think long and hard before using the pension pot as a ‘slush fund’ to pay for these projects, citing Occupational Pension Scheme Investment Regulations, and the EU Directive Institutions for Occupational Retirement Provision.

Under these pieces of legislation, where conflicts of interest exist, any decision on investment must be scrutinised in the interests of scheme members; and any conflicts of interest against them in the decision or the investment process must be resolved in scheme members’ favour.

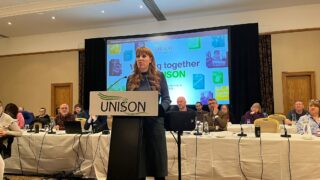

Commenting on the report, UNISON assistant general secretary Karen Jennings said:

“This report must not be seen as a green light for the government to use local government pension pots as a slush fund to pay for massive building schemes – and they would do well to remember the legal protection that covers these funds.

“Any attempt to use these funds – particularly where a conflict of interest, such as massive profits for investment intermediaries and their shareholders – outside of the best interests of the scheme members should expect to be met with a legal challenge.

“The legislation exists to protect scheme members, and will be used to protect their savings.

“Our members working in local government have paid into their pensions in good faith, and will be alarmed to see reports such as this one advocating their hard-earned savings being ploughed into building schemes that will ultimately benefit rich property companies.”

ENDS