The government regulations covering transitional arrangements for the Local Government Pension Scheme are still delayed, because the government has yet to decide whether councillors should continue to be allowed to join the LGPS, following its consultation last year.

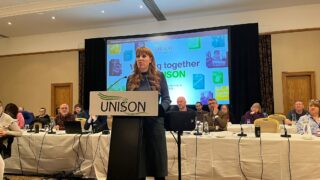

UNISON head of pensions Glyn Jenkins, who sits on the group that is checking the draft regulations, commented: “There are no plans to reduce the protections that have been agreed, which are in the current draft.”

As drafted, this would mean the ‘rule of 85’ protection will go over into LGPS 2014 unchanged from what it is now. So any part of a person’s service that is currently covered by the rule of 85 would not be reduced for early payment if she or he decides to retire at 60, unless they have not completed enough service by that time to satisfy the rule.

Those who voluntarily decide to retire between the age of 55 and 60 with full or part protection for the rule of 85, would have an early retirement reduction unless the employer agreed to pay to remove it.

There is still fine tuning to be done about the level of the reduction in such cases.

UNISON believes it has succeeded in arguing that the reduction will only count back from age 60, not 65, but this will be confirmed when the regulations are laid.

Also as drafted, the current definition of final pay and the protections on pay will remain the same for all service up to April 2014. The underpinning protection for those who were within 10 years of their normal retirement age at April 2012 is also in the current draft.

“UNISON is pushing for the transitional regulations as drafted to be laid as soon as possible, to remove uncertainty,” said Mr Jenkins.

“We are concerned that, because of the delay in bringing the transitional regulations into law, some members are considering leaving the scheme or even resigning their jobs – under the false impression that the protections will not be implemented and, even if they were, the equally false impression that leaving the scheme would somehow protect their past service rights in the LGPS.

“In fact, all those who want the final earnings protection on their LGPS service to April 2014, must make sure they are contributing to the LGPS when the regulations change in April.”

The Scottish LGPS and Northern Ireland LGPS are separate.